SAP S/4HANA Integration We now support the official SAP Integration Flow (iFlow) “SAP S/4HANA Integration with External Tax Calculation Engines” with our tax engine “Global Tax as a Service” Learn more in the video below:

Author Archives: Robert Schmid

Global Tax ABAP Client

Global Tax ABAP Client We are more than happy to announce the availability of the Global Tax ABAP Client today. The Global Tax ABAP Client enables your SAP S/4 HANA system or your SAP BTP ABAP environment to get Global Tax Rates through Global Tax as a Service which is our … Read More

[Important Update] Global Tax 4.0.15

Global Tax 4.0.15: WC 8.1 compatibility Today we released Global Tax 4.0.15. It is an important update for WooCommerce 8.1 based e-Commerce shops and multi-vendor marketplaces. Affected solutions: Global Tax for Dokan Global Tax for WooCommerce Other WooCommerce 8.1 based marketplaces Features: … Read More

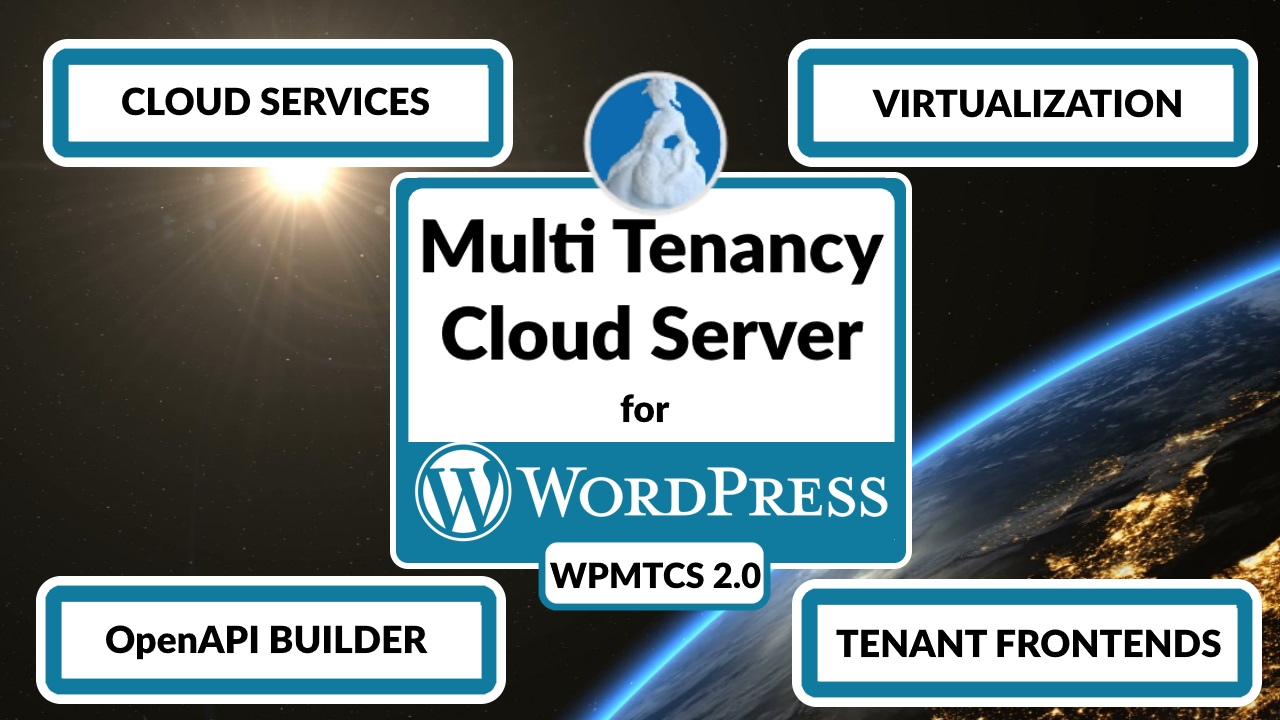

Migration to WPMTCS 2.0 completed

Migration to WPMTCS 2.0 We successfully migrated to Multi Tenancy Cloud Server for WordPress (WPMTCS 2.0). The Virtualization of Tenant Instances enables us to reduce cloud infrastructure and to cut costs by nearly 30%.

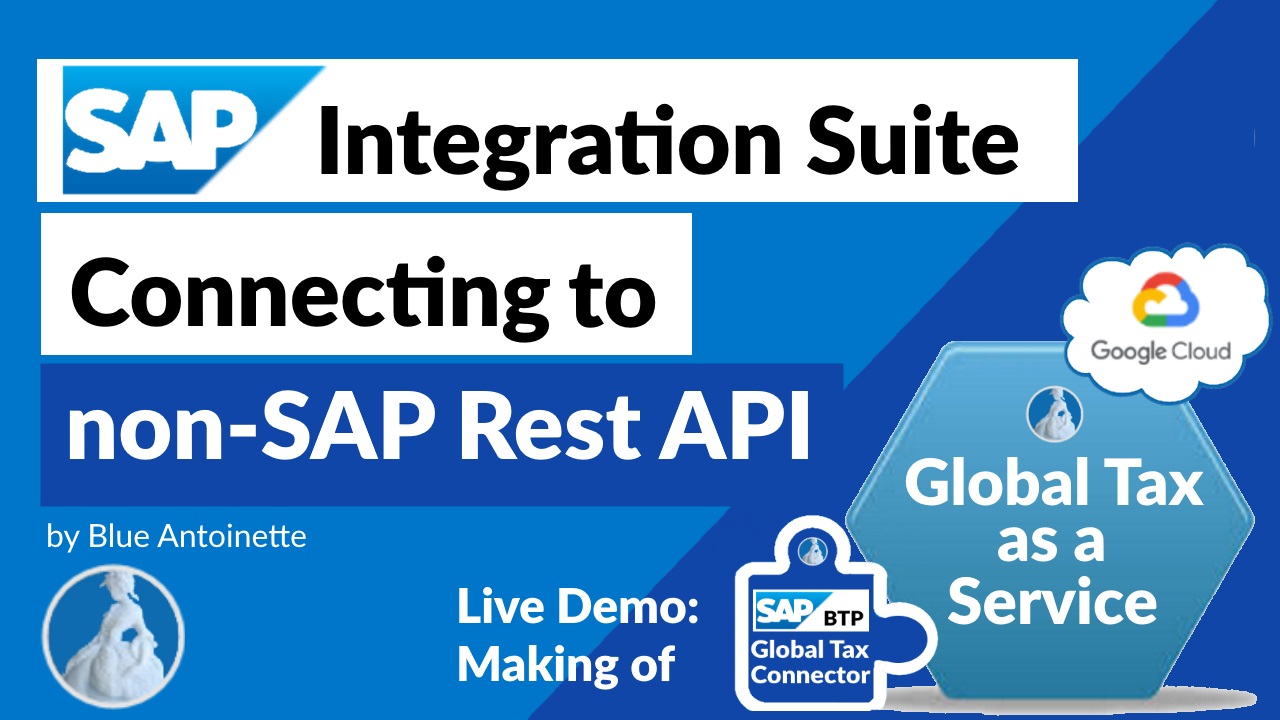

SAP Integration

SAP Integration Integrating SAP with Global Tax as a Service is now easier than ever before. Learn how you can utilize the SAP Integration Suite to connct to our REST API within minutes rather than months. https://youtu.be/lmfZE1PfD7s

[Update]Compatibility Update for WooCommerce

Compatibility Update for WooCommerce Today we released Global Tax 4.0.11. This release comes with a compatibility update for WooCommerce based e-Commerce shops and multi-vendor marketplaces. It supports WooCommerce 6.9.4 and the latest versions of dedicated multi-vendor marketplaces releases like Dokan V3.7.0 Learn … Read More

Global Tax Blockchain Link

Global Tax Blockchain Link How Google Maps interacts with the Ethereum Blockchain to display global indirect tax rates Blue Antoinette to Launch a Chainlink Node to Make Global Tax Solutions Available to Smart Contracts With the rapid increase in financial … Read More

Global Tax 4.0 is here!

Global Tax 4.0 We are more than happy to announce the availability of Global Tax 4.0 today. Global Tax 4.0 is a major release and an important step towards our Multi Cloud Strategy on Kubernetes clusters. This update covers Global Tax as a … Read More

Integration with Blue Antoinette Commerce Cloud completed

We have successfully completed the integration of Global Tax as a Service with the Blue Antoinette Commerce Cloud to help customers to stay compliant with their tax requirements world wide. The Blue Antoinette Commerce Cloud enables customers to to start an online shop … Read More

Protected by Gatekeeper for Google Cloud Firewall

GT4M and Global Tax as a Service is now protected by Gatekeeper for Google Cloud Firewall

Equal Opportunity Tax Solution For Partners

Global Tax as a Service, which is an essential part of GT4M, is the only tax offering listed by Google on their GCP Marketplace. It comes with many benefits for Google Cloud Customers yet, like integrated billing by Google and … Read More

SAP + GT4M

We are more than happy to announce that we have signed an agreement with SAP today. As a specialized member of the SAP® PartnerEdge® open ecosystem we integrate Global Tax for Marketplaces and More (GT4M) with the SAP Commerce Cloud. In combination with our partnership with Google we pursue a Best … Read More

Google Integrated Billing and Single Sign On

We are more than happy to announce that we have signed an agreement with Google last week to further integrate the Google Cloud Marketplace and Global Tax for Marketplaces and More. Global Tax for Marketplaces and More (GT4M), has been made available on the Google … Read More

Switch product tax classes dynamically

GT4M – Global Tax for Marketplaces and More has released a new minor release of Global Tax with amazing features today. Global Tax 3.7 comes with features which enable you to switch tax classes of products dyamically defined by tax … Read More

GT4M – The Big Picture

In course of the further integration of GT4M with eCommerce- and ERP-systems, Apps and Custom Solutions of all kinds, regardless of their platform, we publish today the Big Picture of GT4M – Global Tax for Marketplaces, Merchants, Multinationals and More – A … Read More

Google + GT4M

We are more than happy to announce our brandnew partnership with Google. Global Tax for Marketplaces (GT4M) has been made available on the Google Cloud Platform (GCP).

WP Super Cache and Tax Display

Speeding up your WooCommerce Shop or Multivendor Marketplace with WP Super Cache is a good idea. However, WP Super Cache displays the same cached page to all users worldwide. This means if a customer in the US looks at your … Read More

The cloud is not always a big deal

Today we live in a business world that might give the impression that the cloud and its services, APIs or cloud functions could solve all the problems. Rather, it is the case that every cloud service also requires integration into … Read More

Why Tax Calculation on Checkout is not sufficient

Due to the legislation of many countries, it is insufficient and not compliant to simply perform a tax calculation (or consume a tax calculation service of an external provider) just at checkout. Rather, it is required in these countries to … Read More

B2B, B2C, Goods, Services, Multi Vendors, Worldwide – Everything on a single platform?

Is it possible to run a shop or marketplace for physical goods, digital products and electronic services, for business customers and private consumers and with multiple vendors worldwide on a single platform / site / system? Today many companies run … Read More